Crafting an Effective CRM Software for Insurance Agents

Embarking on the journey of CRM software for insurance agents, the discussion unfolds in a captivating manner, piquing the interest of readers with a promise of insightful exploration.

Detailing the significance and practical implications of CRM software in the insurance sector, this narrative aims to provide a comprehensive understanding of its role in enhancing operational efficiency and client relationships.

Introduction to CRM Software for Insurance Agents

CRM (Customer Relationship Management) software plays a crucial role in the insurance industry by helping agents effectively manage their client relationships and streamline various processes. With the increasing competition and demand for personalized services, CRM software has become a valuable tool for insurance professionals to enhance customer satisfaction and retention.

Importance of CRM Software in the Insurance Industry

- CRM software allows insurance agents to centralize customer information, including policy details, communication history, and preferences, enabling them to provide personalized services efficiently.

- By automating repetitive tasks such as data entry, follow-ups, and reminders, CRM software helps insurance agents save time and focus on building stronger relationships with clients.

- With advanced analytics and reporting features, CRM software enables agents to track key metrics, identify trends, and make data-driven decisions to improve customer interactions and sales strategies.

Popular CRM Software Used by Insurance Professionals

-

Salesforce:

Known for its robust features and customization options, Salesforce is widely used by insurance agents to manage leads, track sales pipelines, and improve customer engagement.

-

HubSpot CRM:

Offering a user-friendly interface and integration with marketing tools, HubSpot CRM is popular among insurance professionals for its lead management and communication capabilities.

-

Zoho CRM:

Zoho CRM provides insurance agents with a comprehensive solution for managing contacts, automating workflows, and analyzing customer data to drive business growth.

Features and Benefits of CRM Software for Insurance Agents

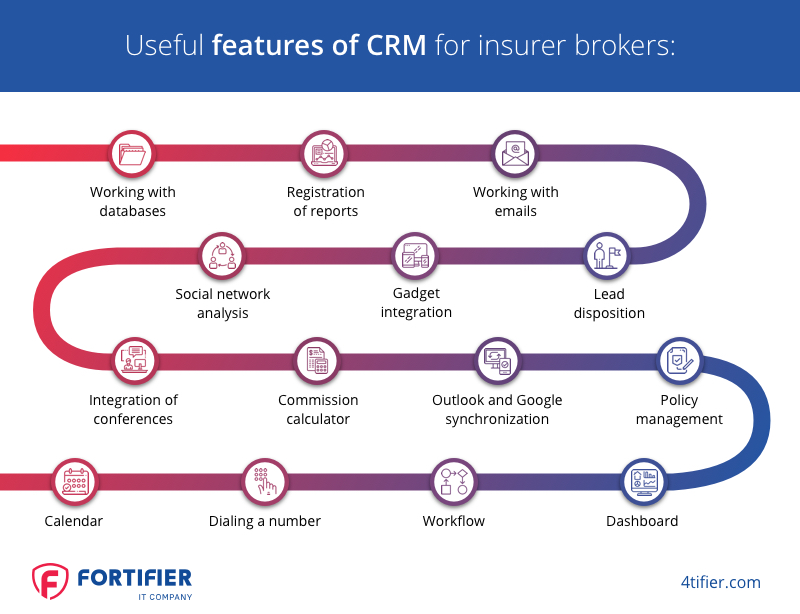

CRM software for insurance agents comes with a range of key features that are tailored to the specific needs of the industry. These features not only help in managing client relationships effectively but also contribute to improving productivity and efficiency within insurance agencies.

Key Features of CRM Software for Insurance Agents

- Client Database Management: CRM software allows insurance agents to store and organize client information in one central location, making it easy to access and update as needed.

- Policy and Renewal Tracking: Agents can track policy details, renewal dates, and premiums, ensuring timely follow-ups and proactive communication with clients.

- Lead Management: CRM software helps in tracking and managing leads, ensuring that no potential opportunities are missed and facilitating the conversion of leads into clients.

- Automated Communication: Automated emails, reminders, and notifications help in staying in touch with clients, sending personalized messages, and maintaining consistent communication.

- Reporting and Analytics: CRM software provides insights into client interactions, sales performance, and overall business operations, enabling agents to make informed decisions and strategize effectively.

Benefits of Using CRM Software for Insurance Agents

- Improved Client Relationships: By having access to detailed client information and communication history, insurance agents can provide personalized services, build trust, and enhance client satisfaction.

- Increased Productivity: Automation of routine tasks, streamlined processes, and centralized data storage save time and effort, allowing agents to focus on high-value activities and client engagement.

- Enhanced Efficiency: With a more organized workflow, better lead management, and automated reminders, CRM software helps in reducing manual errors, improving response times, and optimizing overall efficiency.

- Better Decision-Making: Reporting and analytics tools provide valuable insights that enable agents to identify trends, track performance, and make data-driven decisions for business growth and client retention.

- Scalability and Growth: CRM software can scale with the business, accommodating increasing client volumes, expanding service offerings, and supporting long-term growth and sustainability.

Customization and Integration of CRM Software

Customizing CRM software to meet the specific needs of insurance agents is crucial for optimizing efficiency and effectiveness in their daily operations. By tailoring the software to align with the unique requirements of the insurance industry, agents can streamline processes, enhance customer interactions, and ultimately boost productivity.

Importance of Customization

Customization allows insurance agents to personalize their CRM software according to their workflow, preferences, and business goals. This ensures that the software adapts seamlessly to their existing processes and helps them better manage client relationships, policy information, and sales pipelines.

- Custom fields and data categories can be created to store specific information relevant to insurance policies, claims, and client details.

- Automated workflows can be tailored to match the intricacies of insurance processes, such as policy renewals, underwriting, and claims processing.

- Integration with external systems, such as insurance carriers' portals or quoting tools, can be customized to facilitate data exchange and streamline operations.

Integration with Other Tools and Systems

CRM software can be integrated with various tools and systems used in the insurance industry to create a cohesive and interconnected environment. This integration enables agents to access all relevant information and functionalities from a single platform, enhancing their efficiency and decision-making processes.

- Integration with email platforms allows agents to sync communication history, track interactions with clients, and automate follow-up processes.

- Connecting CRM software with accounting systems enables seamless invoicing, payment tracking, and financial reporting for insurance transactions.

- Integrating with marketing automation tools helps agents nurture leads, create targeted campaigns, and measure the effectiveness of their marketing efforts.

Effective Integration into Workflow

To effectively integrate CRM software into their workflow, insurance agents should prioritize training, data migration, and ongoing support to maximize the benefits of the software. By following best practices and utilizing key features, agents can leverage CRM software to enhance customer relationships, increase sales, and drive business growth.

- Provide comprehensive training to all team members to ensure they understand the features and functionalities of the CRM software.

- Plan and execute a structured data migration process to transfer existing client information, policies, and interactions into the CRM system accurately.

- Regularly review and optimize CRM workflows to align with evolving business needs, industry trends, and customer expectations.

Data Security and Compliance in CRM Software

Ensuring data security and compliance is crucial for insurance agents using CRM software to protect sensitive client information and adhere to regulations.

Importance of Data Encryption

- Implementing data encryption protocols to safeguard client data from unauthorized access.

- Utilizing secure connections (SSL/TLS) to protect data transmission between the CRM software and servers.

- Regularly updating encryption standards to stay ahead of potential security threats.

Role-based Access Control

- Enabling role-based access control to restrict employees' access to sensitive client data based on their job responsibilities.

- Setting permissions and restrictions to ensure that only authorized personnel can view or modify confidential information.

- Monitoring user activities and maintaining audit trails for accountability and compliance purposes.

Data Backup and Recovery

- Automating regular data backups to prevent data loss in case of system failures or cyberattacks.

- Storing backup copies in secure off-site locations to ensure data recovery in the event of a disaster.

- Testing data recovery processes periodically to verify the integrity and availability of backup data.

Final Conclusion

Concluding our discourse on CRM software for insurance agents, we reflect on the key takeaways and highlight the transformative potential of integrating such technology in modern insurance practices.

Q&A

What are the key features to look for in CRM software for insurance agents?

Key features include client management, policy tracking, automated workflows, and integration capabilities for seamless operations.

How can CRM software benefit insurance agents in managing client relationships?

CRM software enables agents to maintain detailed client profiles, track communication history, and provide personalized service, fostering stronger relationships.

Why is data security crucial in CRM software for insurance agents?

Data security is vital to safeguard sensitive client information and ensure compliance with industry regulations, protecting both the agency and its clientele.