Crafting an Effective CRM Strategy for Stock Brokers

Embarking on the journey of CRM for stock brokers, we delve into a world where technology meets finance, revolutionizing how client relationships are managed and nurtured. As the stock brokerage industry continues to evolve, the role of CRM tools becomes increasingly crucial in fostering lasting connections and driving business growth.

In the subsequent paragraphs, we will explore the key features, implementation strategies, benefits, and FAQs surrounding CRM for stock brokers, shedding light on this dynamic aspect of modern financial services.

Introduction to CRM for Stock Brokers

CRM, or Customer Relationship Management, in the context of stock brokerage, refers to the strategies, processes, and technologies that stock brokers use to manage and analyze interactions with current and potential clients. CRM tools are crucial for stock brokers as they help in organizing client information, tracking communication, managing leads, and analyzing customer data.

These tools enable brokers to provide personalized services to clients, improve customer satisfaction, and ultimately increase profitability.

Importance of CRM Tools for Stock Brokers

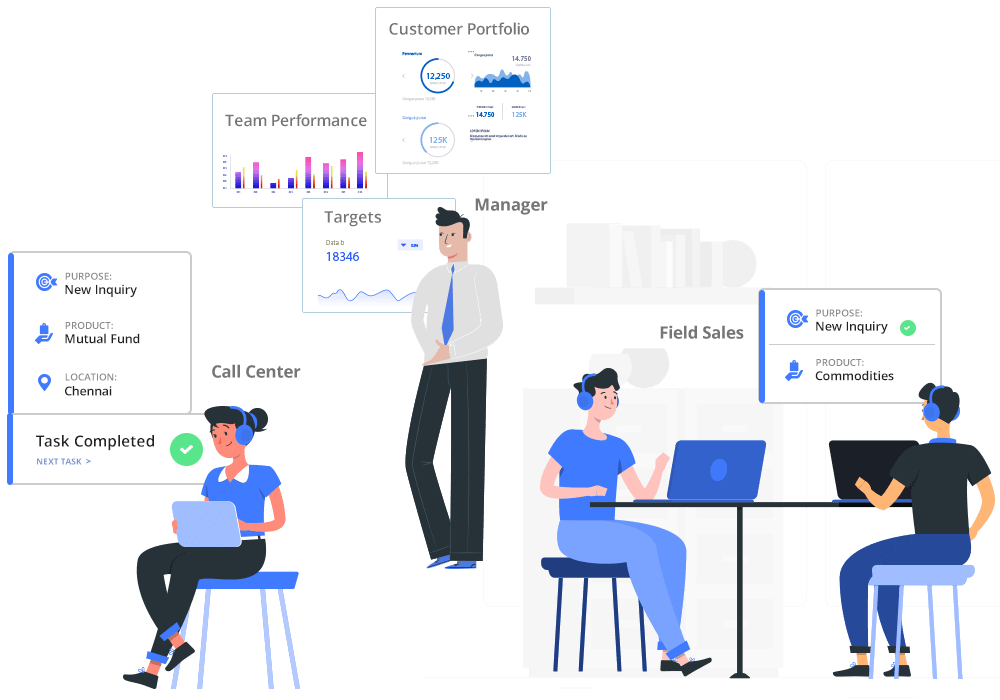

CRM systems play a vital role in the stock brokerage industry by streamlining processes, automating tasks, and enhancing client relationships. Some key benefits of CRM tools for stock brokers include:

- Efficient client management: CRM systems allow brokers to centralize client information, track interactions, and maintain a comprehensive view of each client's portfolio.

- Improved communication: CRM tools facilitate seamless communication with clients through personalized emails, alerts, and notifications, leading to better client engagement.

- Enhanced client satisfaction: By leveraging CRM systems, stock brokers can provide tailored investment recommendations, timely updates, and exceptional customer service, thereby enhancing client satisfaction.

- Increased productivity: CRM tools automate repetitive tasks, such as data entry and scheduling, allowing brokers to focus on building relationships and generating leads.

Effective use of CRM systems can result in better client retention, increased referrals, and overall business growth for stock brokers.

Key Features of CRM for Stock Brokers

When it comes to CRM systems for stock brokers, there are several key features that are essential for optimal functionality and efficiency in managing client relationships and workflows.

Automation

Automation plays a crucial role in CRM tools for stock brokers by streamlining repetitive tasks, such as data entry, lead nurturing, and communication tracking. This feature helps save time and ensures accuracy in managing client interactions.

Customization Options

Customization options are beneficial for stock brokers using CRM systems as they allow for tailoring the platform to specific business needs and preferences. This flexibility enables users to create personalized workflows, reports, and dashboards that align with their unique strategies and objectives.

Implementing CRM in Stock Brokerage

Implementing CRM software in a stock brokerage firm requires careful planning and execution to ensure its effectiveness. Stock brokers may face challenges during CRM integration, but with the right strategies, successful implementation is possible.

Best Practices for Implementing CRM Software

- Define clear objectives: Establish specific goals for implementing CRM, such as improving client communication or streamlining workflows.

- Involve key stakeholders: Engage brokers, analysts, and support staff in the implementation process to ensure buy-in and collaboration.

- Provide comprehensive training: Offer training sessions to help employees understand how to use the CRM system effectively.

- Customize the CRM platform: Tailor the software to meet the unique needs of a stock brokerage firm, such as integrating market data or tracking client portfolios.

Challenges Stock Brokers May Face

- Data migration issues: Transferring existing client data to the new CRM system can be complex and time-consuming.

- User adoption resistance: Some employees may be resistant to change or unfamiliar with CRM technology, leading to low usage rates.

- Integration with existing systems: Ensuring seamless integration with other tools and platforms used by the brokerage firm can be a significant challenge.

Successful CRM Implementation Strategies

- Start small: Begin with a pilot program or implement CRM in one department before rolling it out company-wide.

- Set measurable KPIs: Establish key performance indicators to track the impact of CRM on client relationships, sales, and overall business performance.

- Regularly review and optimize: Continuously assess the CRM system's performance and gather feedback from users to make improvements.

Benefits of Using CRM for Stock Brokers

CRM systems offer a wide range of benefits for stock brokers, helping them streamline their operations, enhance client relationships, and boost productivity. Let's dive into some key advantages of utilizing CRM in the stock brokerage industry.

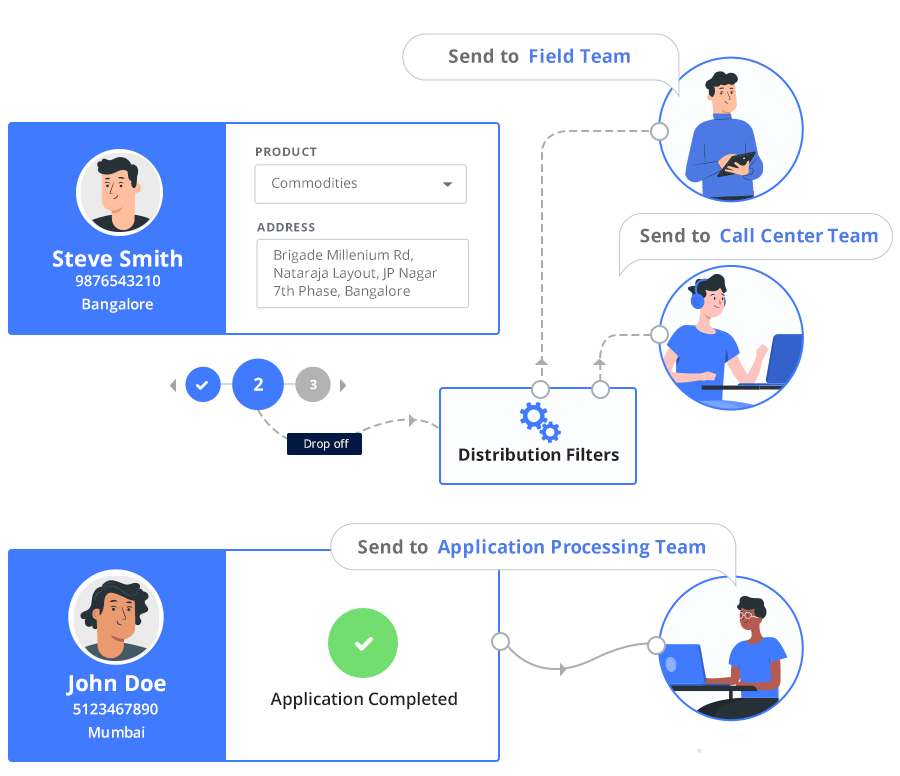

Managing Client Portfolios Efficiently

- CRM systems allow stock brokers to centralize all client information, including investment preferences, risk tolerance, and transaction history, in one secure platform.

- By having a comprehensive view of client portfolios, brokers can provide personalized investment recommendations and tailor their services to meet individual client needs.

- Automated alerts and reminders in CRM systems help brokers stay on top of client interactions, ensuring timely follow-ups and proactive communication.

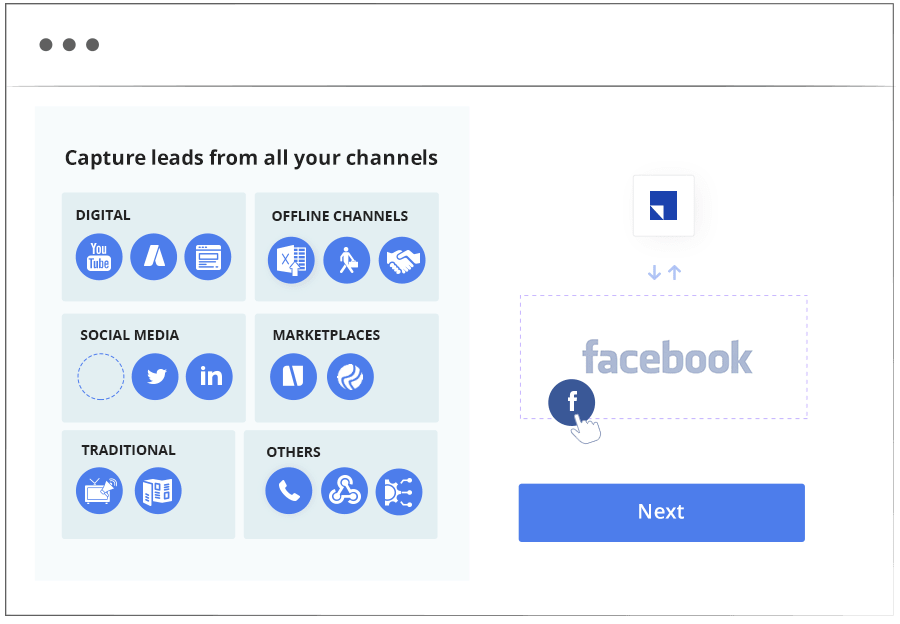

Impact of CRM on Lead Generation

- CRM tools enable stock brokers to track leads effectively, from initial contact to conversion, by capturing and analyzing lead data in real-time.

- By leveraging CRM analytics, brokers can identify high-potential leads, prioritize follow-ups, and tailor marketing campaigns to target specific client segments.

- Improved lead management through CRM systems results in higher conversion rates, increased revenue, and a more efficient sales process for stock brokers.

Enhanced Communication and Collaboration

- CRM platforms facilitate seamless communication and collaboration within stock brokerage teams, allowing for easy sharing of client information, notes, and updates.

- Integrated communication tools in CRM systems enable brokers to communicate with clients via multiple channels, such as email, phone, and messaging, ensuring a consistent and personalized client experience.

- By centralizing communication within CRM, stock brokers can improve team coordination, enhance decision-making, and ultimately deliver better service to their clients.

Conclusive Thoughts

In conclusion, the realm of CRM for stock brokers offers a realm of possibilities for enhancing client interactions, streamlining operations, and staying ahead in a competitive market landscape. By embracing the power of CRM systems, stock brokers can unlock new opportunities for success and sustainable growth in an ever-changing industry.

Essential FAQs

How can CRM systems benefit stock brokers?

CRM systems help stock brokers efficiently manage client portfolios, enhance lead generation, and improve communication within brokerage teams.

What are some common challenges in CRM integration for stock brokers?

Stock brokers may face challenges such as data migration difficulties, resistance to change from employees, and ensuring data security during CRM implementation.

What essential features should a CRM system have for stock brokers?

Key features include client portfolio management tools, lead tracking capabilities, communication channels, reporting and analytics functions, and customizable workflow options.